Download Tutorial

Billing Invoice Overview Example 2 – Invoices with Customized Settlement Solutions with AT&T Control Center

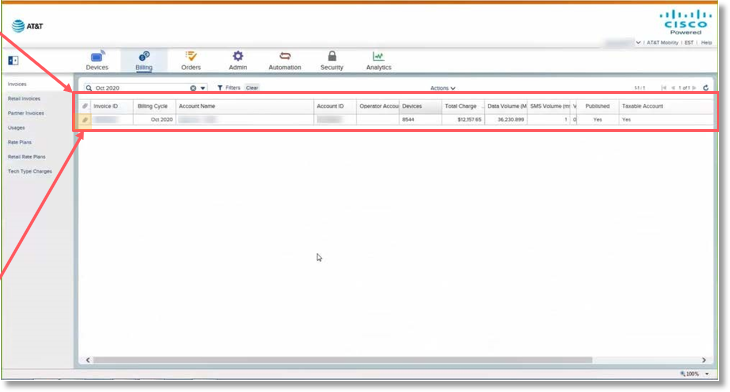

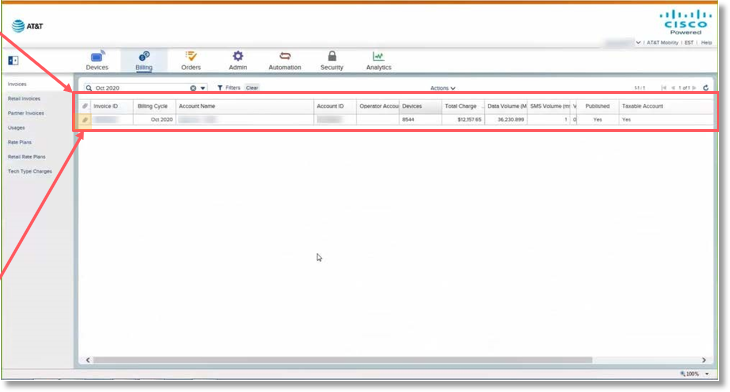

Retrieving an Invoice from the AT&T Control Center

AT&T Control Center Invoice Example 2

Retrieving an Invoice from the AT&T Control Center

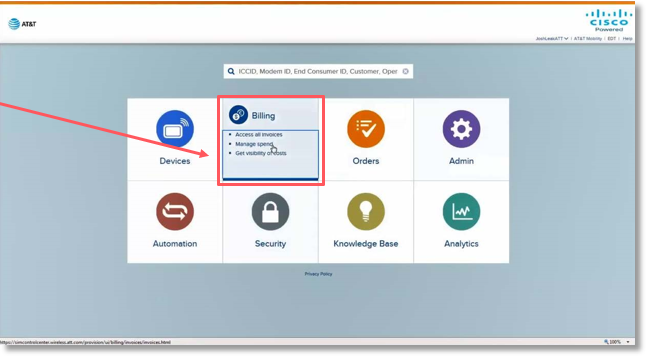

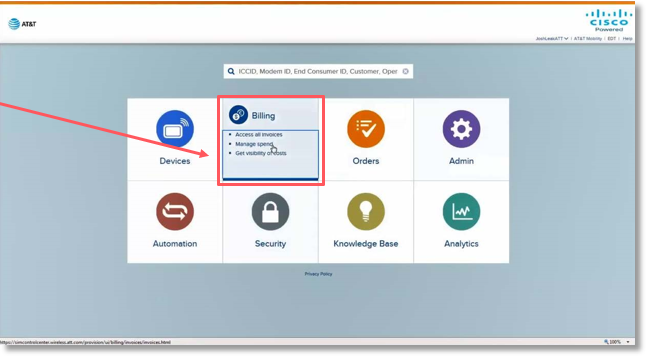

- Access AT&T Control Center

- Select the Billing tab.

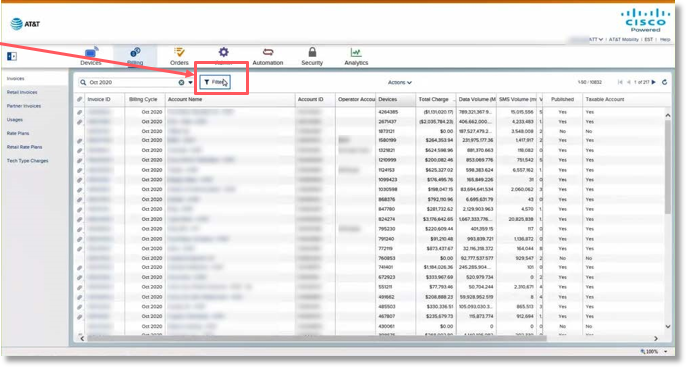

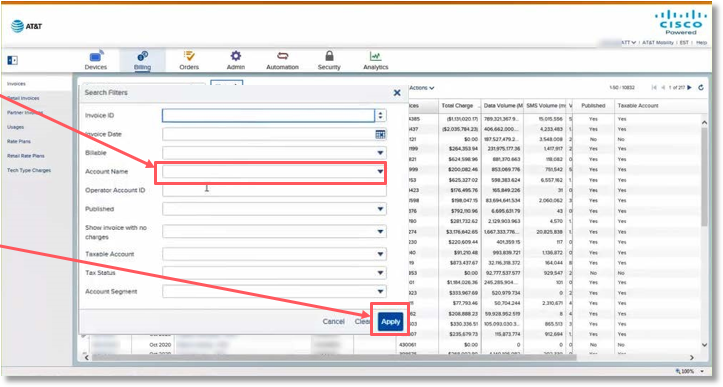

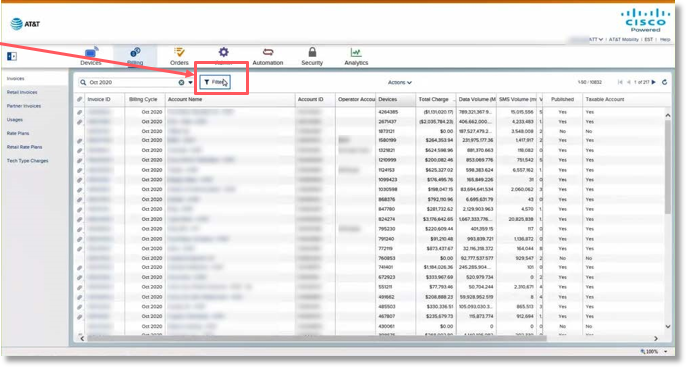

- Select Filter.

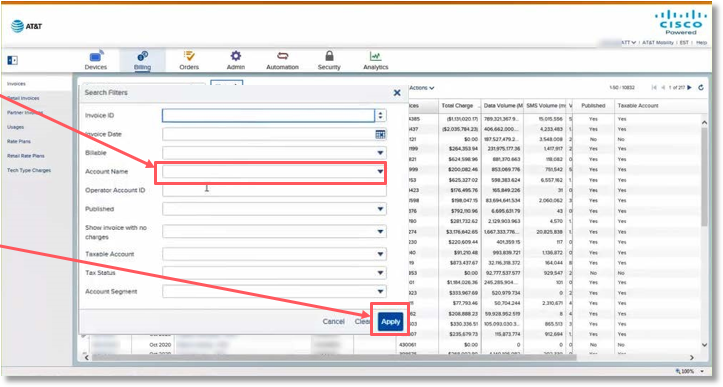

- Enter and choose the Account Name.

Once you type the first few letters of the account, you may see the previous entries by selecting the drop-down menu.

- Select Apply.

The screen will provide a summary of information, such as:

- Link to the invoice (paperclip icon)

- Link to the invoice ID detail

- Billing cycle

- Account Name & ID

- Devices

- Charges

- Volume/Usage

- Open an invoice by selecting the paperclip icon.

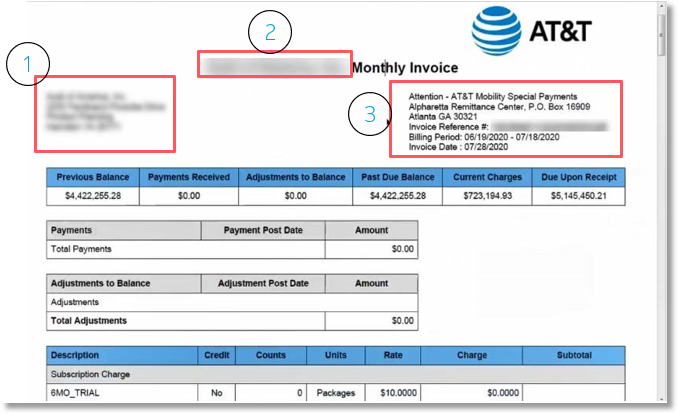

AT&T Control Center Invoice Example 2

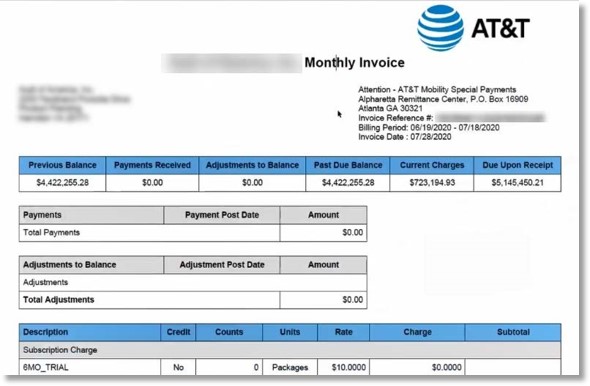

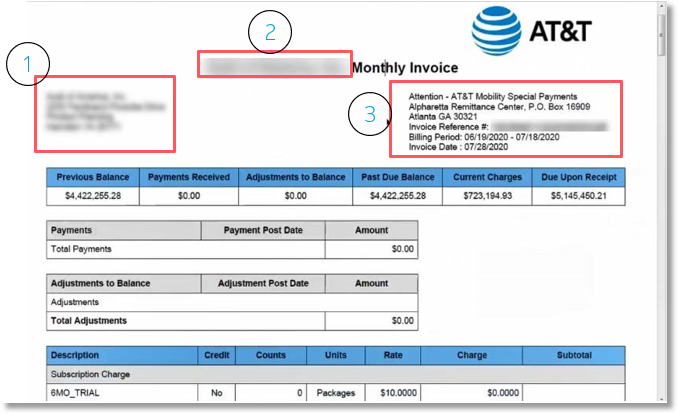

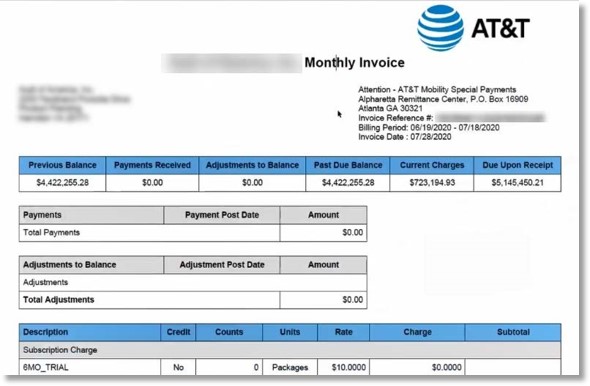

The top section of the ACC Invoice Example 2 provides the following:

- Customer information: Company name, address, etc.

- Purchase Order: Per customer request, this customer has provided a purchase order number that funds are debited from, instead of paying by check or electronic funds transfer.

- Remittance information and invoice information:

- Invoice Reference Number

- Billing Period

- Invoice Date

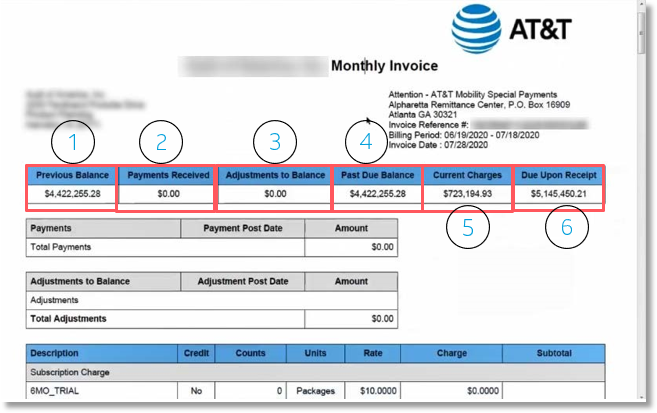

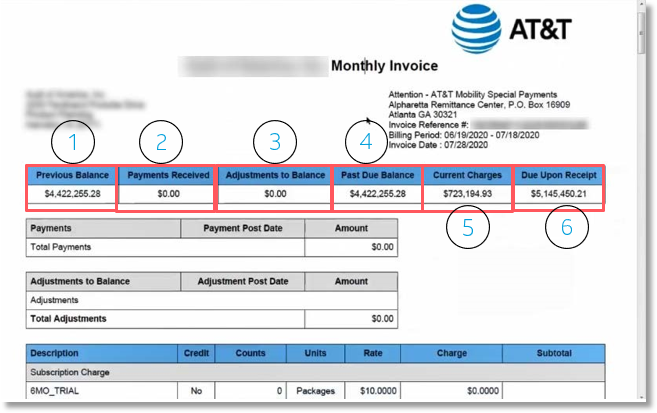

The top section also provides the following:

- Previous Balance.

- Payment received (no payments received in this example).

- Adjustments to Balance, if any (no adjustments in this example).

- Past Due Balance (is the same as Previous Balance when no payments are received and adjustments are applied).

- Current Charges.

- Due Upon Receipt – This is the Past Due Balance and Current Charges added together.

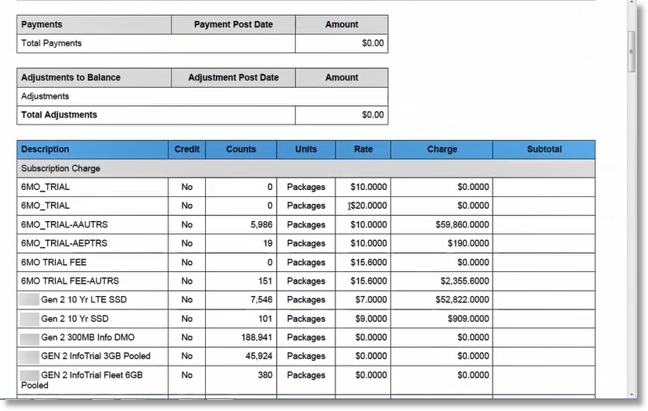

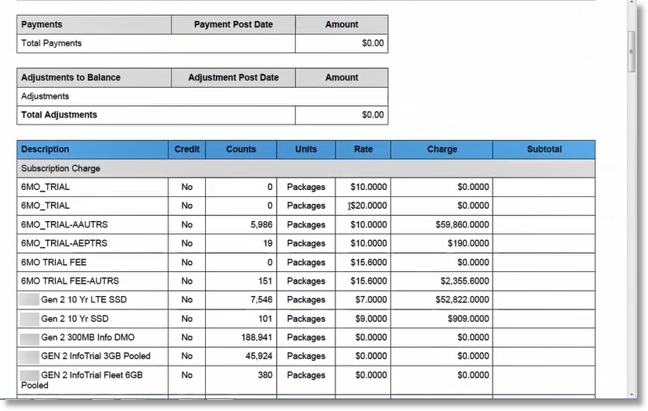

The ACC Invoice Example 2 is broken out into three sections:

- In this example, trials, one-time charges, monthly recurring charges, or other types of charges related to the device.

- Settlements (Retail Revenue Share, Partner Funded Packages).

- Usage

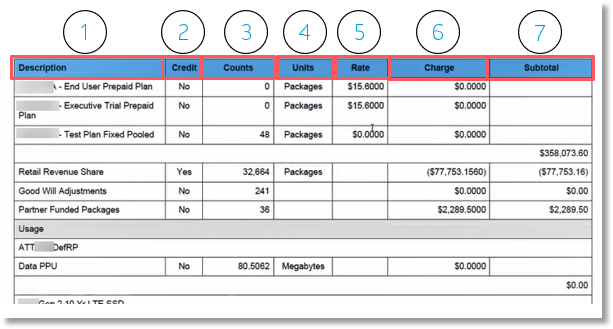

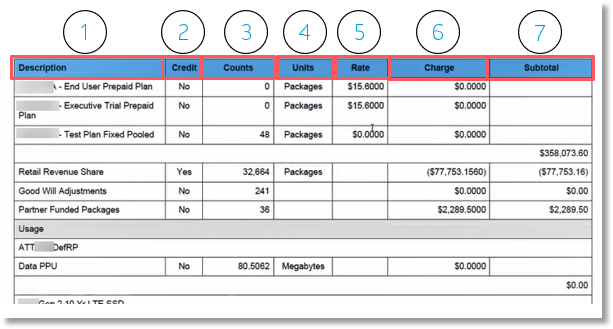

One-time Fees, Monthly Recurring Charges – Column Information/Descriptions

The information provided in the columns includes:

- Description: Provides the wholesale rate plan/retail rate plan for what AT&T is charging.

- Credit: Indicates whether there is a credit. Typically, the indication will be “No” because these are debits.

- Counts: Indicates the number of devices. This is used to calculate the complete charge.

- Units: Packages is indicated, which is the measurement.

- Rate: This is the rate for each count in column 3.

- Charge: Counts x Rate = Charge.

- Subtotal: The subtotal of these charges is provided at the bottom of the section.

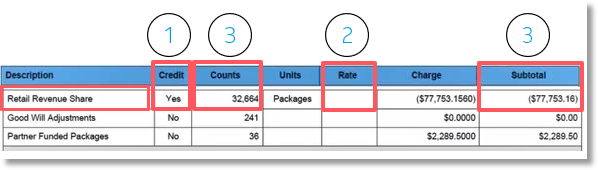

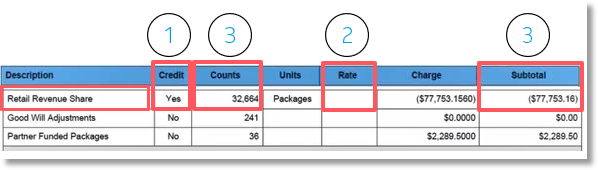

Settlements

Headers across the top are the same as the previous section.

- Key difference in this section – There could be a “Yes” indicator in the Credit column, as this in this example. This means a credit is being applied to the invoice.

- The Rate column is blank because these amounts are vary. JPO Reports can be used to validate the numbers.

- There were 32,664 devices that triggered either a debit or credit. In this example, the net resulted in a credit in the customer’s favor of $77,753.16.

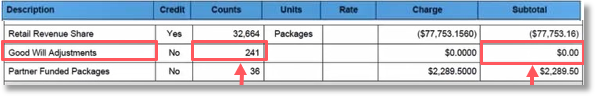

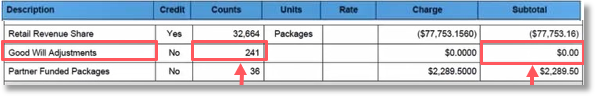

Adjustments

Headers across the top are the same as the previous section.

In this example, there are 241 devices, but there is no charge because they are Good Will Adjustments.

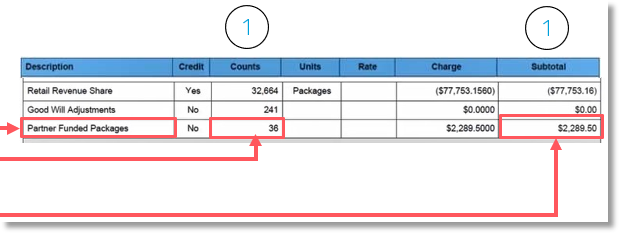

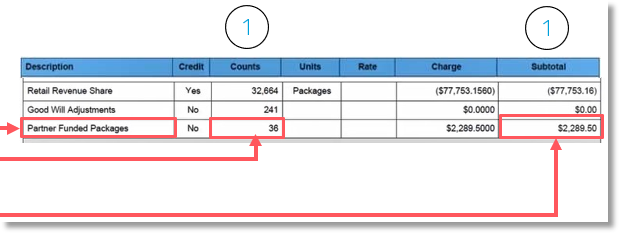

Partner Funded Packages (Retail Plans)

Headers across the top are the same as the previous section.

36 devices. No rate is listed because there are multiple different rates.

The 36 devices generated a charge of $2,289.50.

Note: The subtotal is provided for each line item in the Settlements section.

Usage

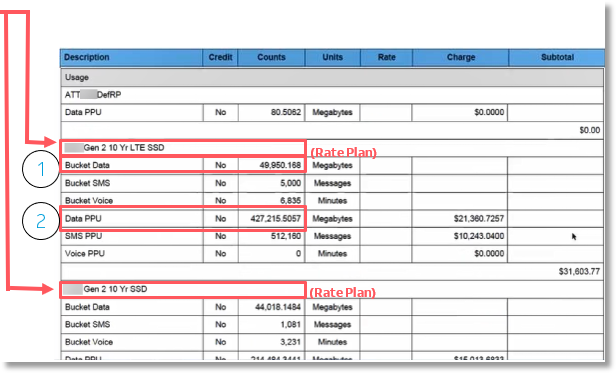

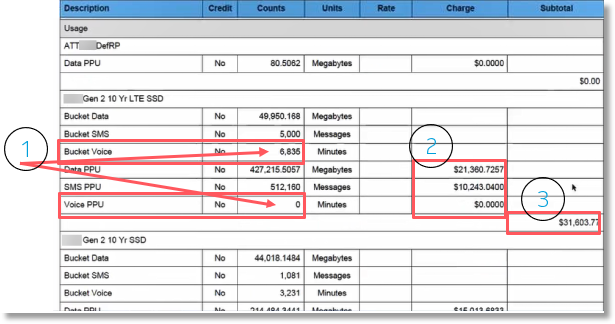

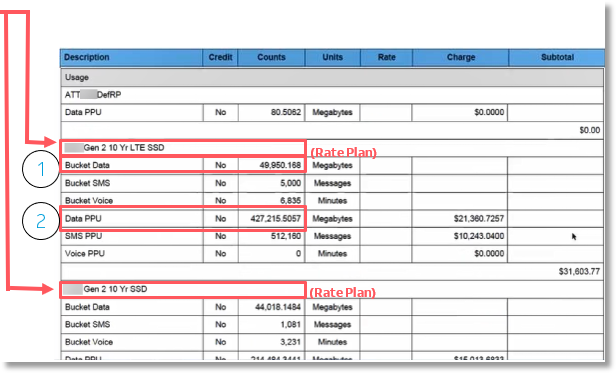

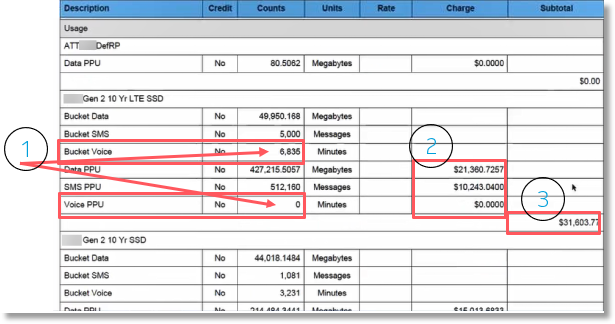

Each subsection within the Usage section is broken down my rate plan, and then by usage type.

Rate Plans on these types of invoice are often pooled plans. There are two types of usage on pooled plans.

- Bucket – The amount of data used that did not exceed the plan allotment. In this example, for all devices, there is an included 49,950,168 MB of usage.

- Pay Per Use (PPU) – Usage over the allotment. This is what creates a usage charge. Bucket Data and Data PPU = Total Data Usage. It is important to remember that bucket usage is subtracted from the total usage to calculate the usage charges. The PPU determines the overage rate.

SMS and Voice Bucket and PPU are detailed and calculated the same Data Bucket and PPU.

- In this example, you can see the customer did not exceed their voice allotment of 6,835, so there are no additional PPU charges.

- Under usage, each Rate Plan on the account is broken out in this way. Each section provides the charges by line item. Those line items combined show the overage for the Rate Plan on this example invoice.

- Adding together the total charge of each rate plan will provide you with the total usage charge.

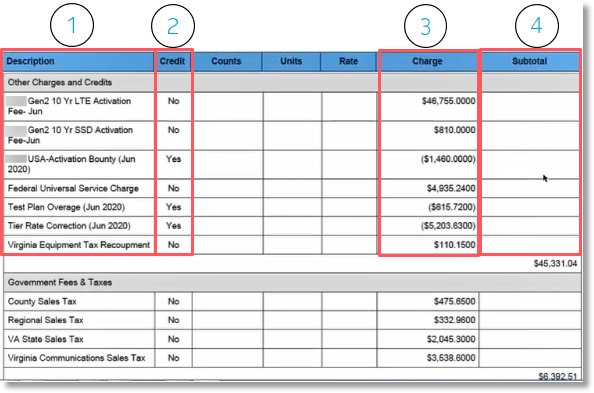

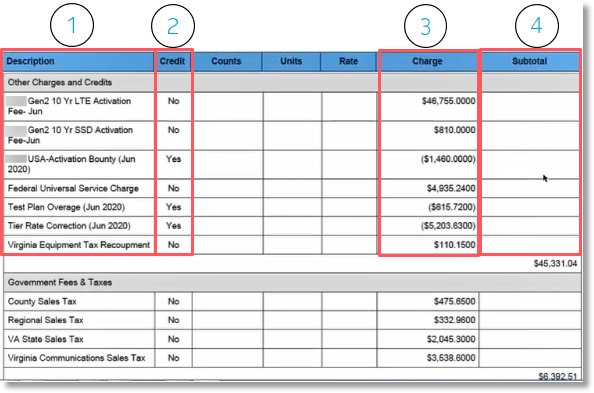

Continue scrolling to the Other Charges and Credits section, which provides the following:

- A description of any charges/credits (adjustments) made to the invoice.

- A Yes or No to indicate if there is a credit.

- The actual charge (or credit).

- The subtotal of Other Charges and Credits.

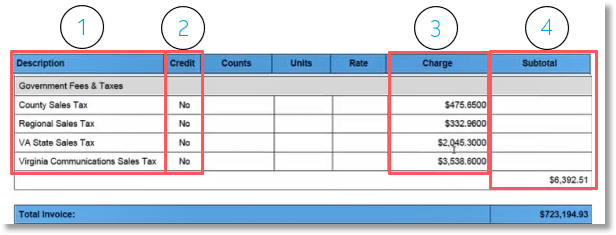

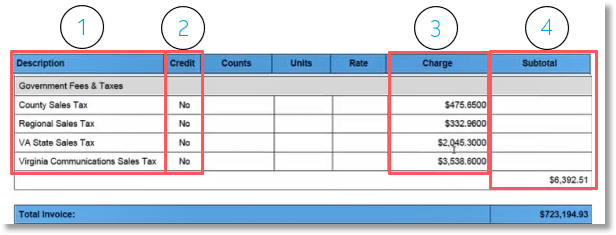

Continue scrolling to the Government Fees and Taxes section, which provides the following:

- A description and breakdown of each fee and tax.

- A Yes or No to indicate if there is a credit.

- The actual charge (or credit).

- The subtotal of Government Fees and Taxes.

The Total Invoice Charge is each of the section Subtotals added together.